What happened elsewhere?

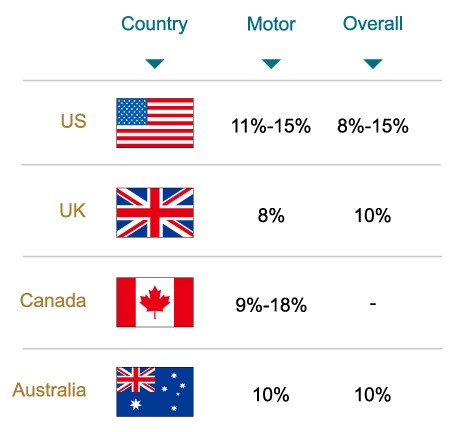

Insurance fraud is a worldwide problem. In some developed markets, approximately 10%-15% of the claims paid out is fraudulent.

“The Association of British Insurers estimates that fraud adds, on average, an extra £50 to the annual insurance bill for every UK policyholder.”

“In 2014, the UK insurance industry detected 67,000 cases of motor insurance fraud with a combined value of £837 million.”

“South Korea's authorities detected insurance fraud cases worth US$314 million during the first half of 2016, up 12.1%, compared to the corresponding period last year.”

- Korean Life Insurance Association

“It is estimated that insurance fraud costs the US $80 billion dollars or more a year. Those costs get passed down to consumers. The Coalition Against Insurance Fraud (CAIF) estimated that cost to be approximately USD $950 per family.”

The next time you look at your premiums – not only do you have to bear in mind your age band, your asset’s value, your health condition(s), your license, your driving history and the like. You should also think about how fraudsters are actually stealing money from your pockets.

Insurance Fraud Cases in Hong Kong

“The ICAC has arrested 22 people and shut down a syndicate believed to be behind an HK$18 million insurance scam involving staged labour injuries and traffic accidents in Hong Kong and the Mainland.”

- HK Government Archive

“Four doctors are among a group of 31 suspects arrested for alleged traffic-accident scams that have cheated insurers out of HK$3 million, police say.”

- South China Morning Post

“A Hong Kong mother tried to defraud an insurance company HK$2 million as she failed to disclose to the insurers that her baby was covered by a second policy and gave false information to the insurers when filling out the claims questionnaire.”

- Mayor Brown